Our ongoing technology initiative Project RED aimed at bringing transformational changes by strengthening processes across verticals, organically linking our work culture, deepening customer engagement, and adopting best-in-class technology to build further capacity.

The transformational changes implemented within the Company also included the ongoing technological advancements. With effective deployment of technology in all aspects of our operations, which resulted in streamlined processes and augmented operating efficiencies, we continue to provide our customers with seamless experiences across channels.

Through Project RED (Reimagining Excellence through Digital Transformation), our digital transformation project ongoing since FY 2020-21, we endeavour to improve our efficiencies at every level of the organisation and enhance service standards. With this, our key objective is to create value across the entire spectrum of stakeholders including employees, shareholders, business associates, existing and potential customers.

We continue to focus on proactively deploying new technologies that help us improve our operational efficiencies and cost effectiveness. We changed our technological platform, implemented a new Lending Management Software and also implemented SAP.

Bringing about differentiated loan journeys to borrowers right from:

Project RED works with the ultimate objective of organising and automating every facet of customer interaction. Initiatives under digital transformation includes providing services to customers digitally, including integration for digital lending and self-servicing modules. It aims at digitally providing all services in the coming days to reduce TAT and physical movement.

We also engaged Boston Consulting Group for transformational changes. A high-level project implementation group has been created to approve and monitor capacity building plans of every constituent. With this, we propose to ensure a uniform approach for managing and regulating entire gamut of operations through collaboration of all functional departments.

The Company has introduced digitalised internal processes for procurement and internal servicing. Customer servicing using customer portal is another area where the payment processing has been digitised. Collections using various digital and auto debit payments forms over 75% of monthly collections. Our customers have embraced digital technologies and processes in customer acquisition, customer appraisal, KYC are already automated.

Our Deposits Module, one of the early implementations under Project RED, has been a huge success, with reduction in overall deposit creation and settlement on maturity. It is aimed at improving customer journeys, reducing TAT and enhancing productivity.

Credit appraisal using STP is another step taken in this direction by reducing manual intervention. The objective loan appraisal has helped in reducing timelines for entire appraisal process. Further, digitisation of documents to reduce paper trail and use of electronic documents for various operations such as subsequent disbursement etc. is becoming part of operations and increasing efficiency.

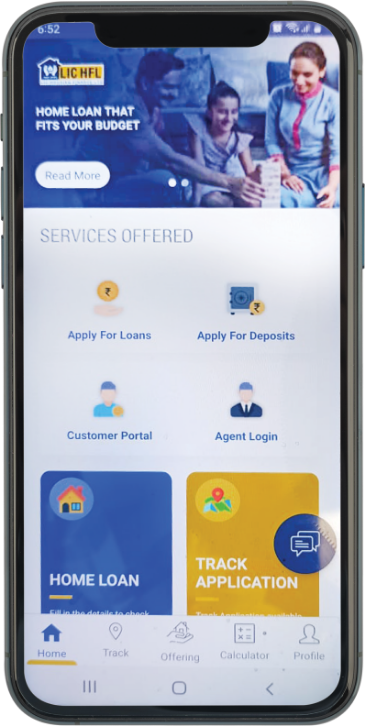

HOMY, our home loan mobile app introduced in FY 2019-20, has been a great success offering customers a convenient way of availing home loans through the online channel. HOMY plays a vital role in furthering the Company’s digital lending process. It eases the process of applying for loans and sanctions and deepens customer engagement through best-in-class technology. Depositors are also onboarded through HOMY.

During the year, online home loan sanctioned through the App amounted to ₹ 2,115.71 crore. The App has managed to facilitate 1,39,888 home applications since its launch. Nearly 1,01,937 of these customers have had their home loans sanctioned. Of these, loans have been disbursed for an amount of ₹ 22,486.33 crore to 93,957 customers.

applied for loans valued at

sanctioned valued at

valued at

Going ahead, we are working on moving faster in adoption of digitalisation, such as AI and ML to develop our business intelligence further. We are also working on a Credit Scoring Model for lending borrowers to understand creditworthiness and objectively identify their credit scores. Through our new tech platform, we are overhauling the deposit mobilisation and administrative process. This mobile app is aimed at significantly reducing TAT and improving customer service. We plan to use more third-party tools for verification to help increase productivity per employee and facilitate employees to engage in core activities. To give our customers the comfort that their primary documents are safe and secure, and implementing digital mechanisms, we are working on getting digital security certification for our data centres.

© 2024 LIC Housing Finance Ltd. All Rights Reserved